Silver: The Technical Downside Case Just Got Worse

Silver is down 10% overnight on Monday, following the huge sell-off on Friday. The price even temporarily broke below Friday’s low, which is probably not what you’d see after such a big drop if buy-the-dip momentum was strong. In other words, the technical picture for silver has arguably gotten worse than it already was.

If the daily close ends up being lower than Friday’s low, I’d be very wary. No confirmation of that yet, but it’s not looking great.

UPDATE:

The article below was meant to be published YESTERDAY on a different platform before Sunday evening’s market open, but due to some issues with the other platform, things got delayed, and I decided to just post the article here instead…at 3:30 AM EST. Plus, I like you guys on Substack.

Rather than rewrite the analysis after the 10% drop, I’m publishing the original piece, so you could see more of what my thought process was.

As I laid out in my previous piece, “Silver Crashed 35% in a Day. Why I’m Not Buying the Dip” (linked here), this was a textbook outcome for an overextended market.

Violent bounces can happen after crashes like this, but they rarely mark the start of a fresh leg higher. More often, they’re part of a broader process of excess being worked off.

That’s what I showed in my original article below. I showed how this price action mirrors past silver tops in 1980, 2011, and 2020-2021. I also talk about the negatives of increased margin requirements and uncertainty regarding Kevin Warsh.

Without further ado, here it is…what was meant to be published yesterday:

Silver: Take Your Profits Before It’s Too Late

Silver crashed on Friday, finishing 26% lower while at one point, it was down almost 40% from its January 29 high. But I don’t think this is a great buy-the-dip moment. At least not for the medium term.

I see serious warning signs from silver’s price action that mirror its past peaks. Further, Trump’s choice to appoint Kevin Warsh as Fed Chair, who seems to be more conservative than Powell, introduces uncertainty for monetary policy, which I don’t view as a positive for silver at the moment.

Another reason I’m not optimistic about silver now is due to the CME increasing margin requirements on gold and silver recently. Margin requirement increases also happened during other silver tops.

The recent silver rally seemed to be very speculative, partly driven by fear of missing out, but things like that don’t last forever. Therefore, I believe silver is a Sell. And what I mean by Sell isn’t to go short (at least not yet), but I advise against holding the metal, as downside risk is real.

Friday’s Price Action Was A Warning Sign

Let’s take a look at Friday’s price action. Below, you see a parabolic move followed by a big crash. Anyone who has been in the market longer than a few years should be familiar with this pattern. It’s nothing new, especially not with silver, as I’ll show later on. It’s what happens when speculative dreams of doubling your money in a few months meet reality.

You’ll also notice that the 9-day exponential moving average did not act as support this time, as it had been for the past two months. That signals a major short-term breakdown.

On the weekly timeframe, there was a big bearish engulfing candle, which is never a good sign.

How Does This Price Action Compare To Past Peaks?

Let’s Start With Silver’s Peak In 2011.

The price had gone from around $9 per ounce to around $50 in under three years. The move started to get more aggressive near the top, and silver was then met by a 26% drop for the week ended May 6, 2011. That sounds familiar. The drop started on May 2nd, where silver fell by 8.31% for the day, followed by three more consecutive red days.

What sparked the drop? Two events: Bin Laden was killed (removing some of the risk premium in commodities), and margin requirements for trading silver were increased.

The latter half of that last sentence sounds familiar as well.

Importantly, what happened after that was a dead cat bounce, followed by more losses and a nine-year downtrend until silver picked up again during the pandemic stimulus days.

What About 1980?

This one is even more insane. The price went from around $5/oz in the middle of 1978 to around $48/oz by January 1980. Again, though, we can see a parabolic rise followed by a huge bearish engulfing candle. Silver again finished just over 26% lower that week. What followed was a dead-cat bounce and more losses. Long periods of losses. Silver didn’t truly start recovering until the 2000s.

Interestingly, margin requirement changes also were part of what triggered the crash in 1980. Back then, the Hunt Brothers were quickly accumulating silver to the point where they owned one-third of the world’s privately-owned silver. They believed that fiat currencies would lose their value, so silver seemed like a good way to protect against that. Then, margin requirements were changed, and things went south.

Here’s how Investopedia described it:

In Jan. 1980, however, the price of silver declined by over 50% within less than a week, partly due to new restrictions placed on speculative margin traders. The Hunt brothers, who despite their own fortunes had relied heavily on margin loans to fund their silver purchases, were faced with severe losses on their position. Soon, word began to spread that the brothers were starting to face margin calls from their brokers.

As often happens in periods of financial crisis, rumor mixed with reality to cause investor sentiment to turn. Silver, which had only recently risen almost ten-fold in the previous years, now seemed to be in freefall.

Silver’s Price Action During COVID Can Also Teach Us Something

This one is a little bit different than the two examples above because the move higher wasn’t as explosive, but we can still learn from it. Silver had risen quickly from the pandemic lows and was getting pretty euphoric at one point. Then, on August 11, 2020, silver finished 13.7% lower (the first black arrow on the chart below), sending a familiar warning.

After this, we saw a dead-cat bounce, followed by a 7.7% down day on September 21, 2020 (the second black arrow) and sideways price action from there. That’s also pretty familiar.

Silver then tried to break past the 2020 highs in early 2021 (the third black arrow) when short squeezes were trending, but that failed. That was the third warning. After that, silver stayed pretty stagnant until 2024.

The takeaway here is that strong upward moves followed by huge red candles of 10-20%+ are big warning signs that shouldn’t be taken lightly.

I also want to highlight that price action should be respected despite how many reasons there are to buy silver. For example, in late 2020 or 2021, I know many were making the argument that reckless money printing would send silver even higher because people would buy metals to protect against upcoming inflation, but the upward move in silver didn’t happen after that initial rally. At least not during those years.

Kevin Warsh As Fed Chair Introduces Uncertainty

On Friday, January 30, Trump picked Kevin Warsh to be the next Federal Reserve chair, and that actually helped trigger the sell-off we saw in silver. The senate still has to nominate and confirm Warsh’s position, but if so, he’d replace Jerome Powell, whose term ends in May.

I think this move introduces uncertainty. Kevin Warsh has a reputation for being a “hawk,” or being restrictive with monetary policy, which generally isn’t good for gold and silver. At the same time, some say he may not be as hawkish as his reputation suggests. That’s what makes it confusing.

For example, here’s a quote from an article that talks about him being a hawk because he was warning about inflation even when the economy was struggling during The Great Recession:

During the 2010s, he became known within Wall Street and Washington circles as one of the fiercest critics of the Fed’s zero-interest-rate policy, to the point of warning about inflation when unemployment was still at 10 percent. “He’s a pretty stone-cold hard-money guy,” Jared Bernstein, who served as the chair of Joe Biden’s Council of Economic Advisers, told me. “It’s a peculiar choice for Trump, because the Fed that Warsh wants is very different from the one Trump wants.”

He even spoke out against the Fed’s promises to cut rates in 2024, saying that the Fed was “goosing” the economy.

On the other hand, you have this quote from James Thorne, chief market strategist at Wellington Altus:

In reality, Warsh is clearly aligned with President Trump’s productive‑capital, supply‑side agenda: prioritizing investment, productivity, and private‑sector credit creation over financial engineering. Advocating a supply‑side agenda gets labeled “hawkish” by Wall Street, but it’s really an anti‑Keynesian stance, not a reflexive preference for tight money. Yes, QE was a failure, and questioning it does not make you a hawk.

Also, Dario Perkins, strategist at T.S. Lombard, believes that his hawkish reputation will actually make it easier for him to convince a skeptical FOMC to lower rates.

More recently, supposedly in late October, Kevin Warsh supported lowering rates.

I guess we should weigh his recent words more heavily. Lowering rates could help metals, but we also need to remember that Warsh is someone who will keep a very close eye on inflation. I mean, he was worried about inflation during The Great Recession.

If he ends up being extra cautious about inflation, that will hurt the narrative of investing in silver as a hedge against inflation. It’s also possible that long-term treasury yields can come down if Warsh causes inflation expectations to drop. In other words, money can flow into bonds and out of silver.

But again, I really can’t predict what’s going to happen here. At least with Powell, we had a better idea -- less uncertainty -- which was better overall for silver, in my view.

Increasing Margin Requirements For Silver Kill Momentum

The CME recently increased the margin requirements for silver and gold futures. CNBC reported on January 31 that “Silver margins will increase to 15% from the present 11% for the non-heightened risk profile.” At the same time, “The heightened risk profile margins will witness a hike to 16.5% from the present 12.1%, as per the statement.”

If you want momentum, that’s a step in the wrong direction, and it mirrors what has happened in other silver crashes. Investors buying on margin is what helps drive crazy moves like the ones we saw.

Sentiment Got Too Crazy

I don’t need to tell you this. If you’ve been on X or any social media platform where silver was mentioned, you probably saw how wild the sentiment got. It was the same type of “to the moon” rhetoric I saw in other euphoric bubbles. Someone I know even ended up buying physical silver recently. And this “someone” is not one who is known for investing in metals. You probably know how that generally ends up playing out.

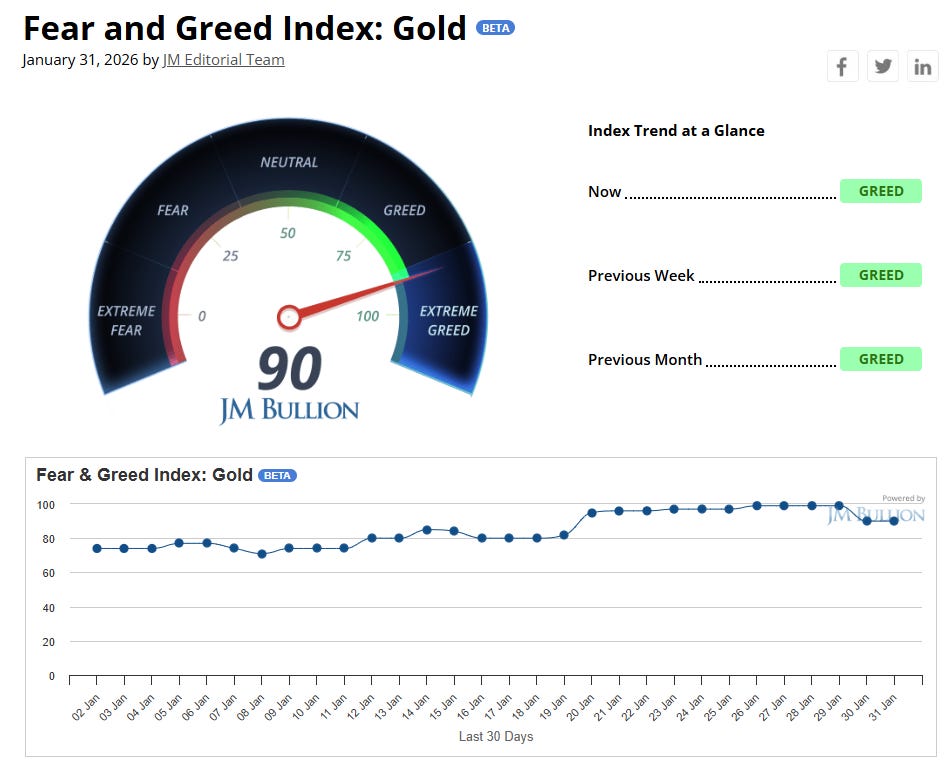

Even the gold fear & greed index (I couldn’t find a silver one, but the results for gold should be very similar) shows that we’re in extreme greed territory -- 90 out of 100. See below.

But The Trend Isn’t Completely Broken Yet

I want to be fair here. Earlier, I showed why the chart setup isn’t great right now and I mentioned how silver finished under the 9 EMA on the daily time frame. At the same time, the metal did bounce well off its low to finish the day, and if you look on the weekly timeframe (take a look at the 2nd chart in this article), you’ll see that the price didn’t close under the 9-week EMA. And that moving average has acted as support on the weekly timeframe since the middle of last year.

Therefore, I can reasonable conclude that in the shorter term, AKA the daily time frame, the trend is broken. On the weekly timeframe, there was a huge warning sign, but it’s not completely broken yet. So that’s the caveat. A close under the 9-week EMA would be an extra warning, and a break under Friday’s low would be deadly, in my opinion.

The Bottom Line On Silver

Silver’s recent price action reminds me of other times when the metal has peaked. Friday’s sell-off was a big warning sign that could signal a top in silver, even if a short-term bounce happens from here. Friday’s low and the 9-week EMA are key levels to watch.

Price action aside, sentiment got too hot, too fast, and it needs to cool down. Making matters worse is the increased margin needed for trading silver futures now, as that surely won’t help the metal regain momentum. In fact, other peaks for silver have also included increased margin requirements.

To top it all off, Trump’s recent decision to pick Kevin Warsh as the Fed chair introduces uncertainty that makes me want to stay away from silver even more, although that’s not the main reason I’m cautious.

Overall, I advise against holding silver, as the risks are too high. Therefore, I give silver a Sell rating.

Reminder that this article was written when the price was ~$85. But the risks are still high now, even if a bounce happens.

Thanks for reading! If you liked this article and found it valuable, please consider subscribing! It will help me out a lot, as articles like this take lots of time to write. Best of luck to all of you!

We will see, I suppose.

I don't see any change in the underlying fundamentals in physical silver between today and 29 January. You still can't buy it locally where I am - Perth Mint has suspended taking orders for a month - and if you can buy it from local dealers at all, the buy price hasn't changed between today and 29 January. They are still asking the pre-crash price. The only thing that has changed is the sell price.

Well, especially with the shortage, it's significantly different than what every writer from the Silver Squeeze team writes. Behind them are the modern Hunt brothers. Silver is estimated at 2 billion ounces in free float. Consumption is falling, and recycling technology is significantly improving on previous years' results. In such a small market, it is not difficult to create a physical shortage given today's volume of money.